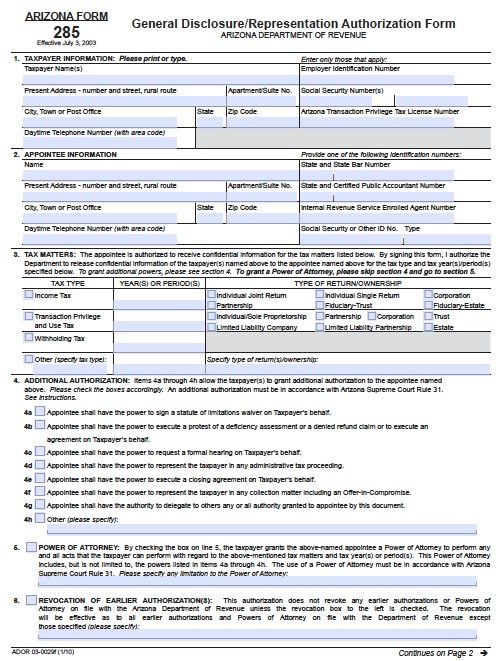

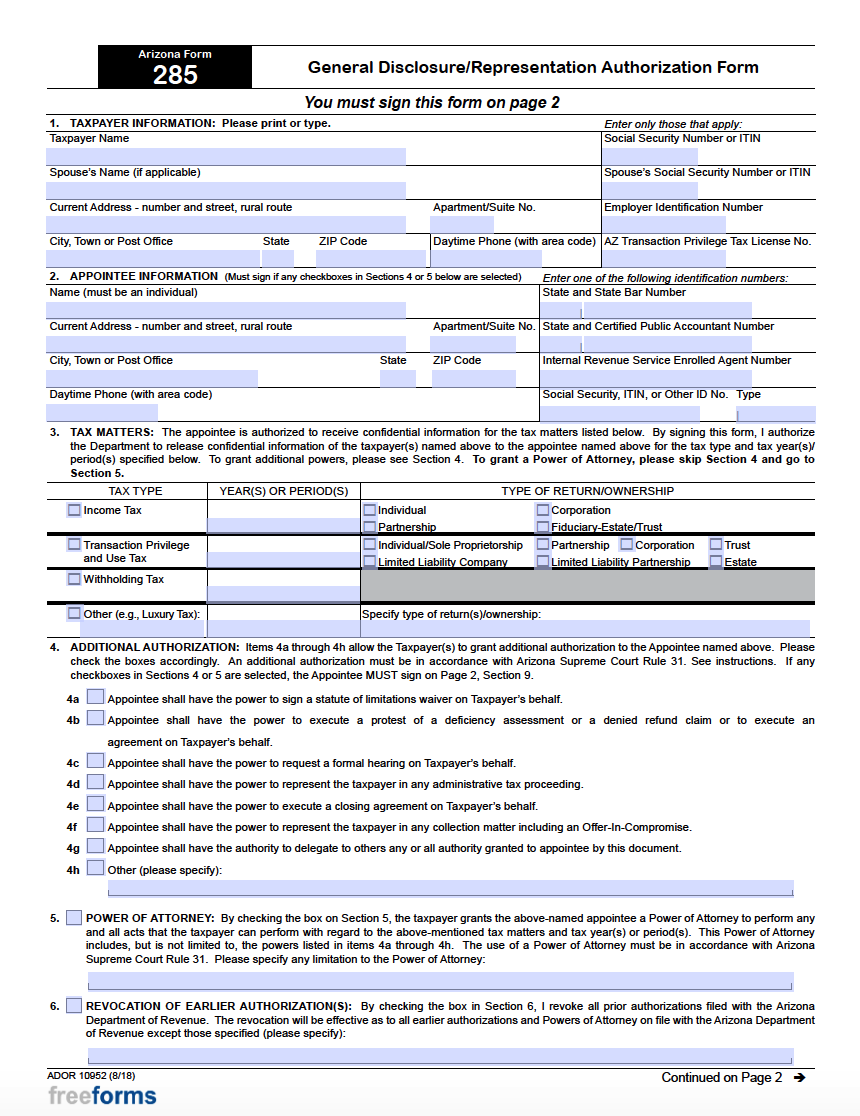

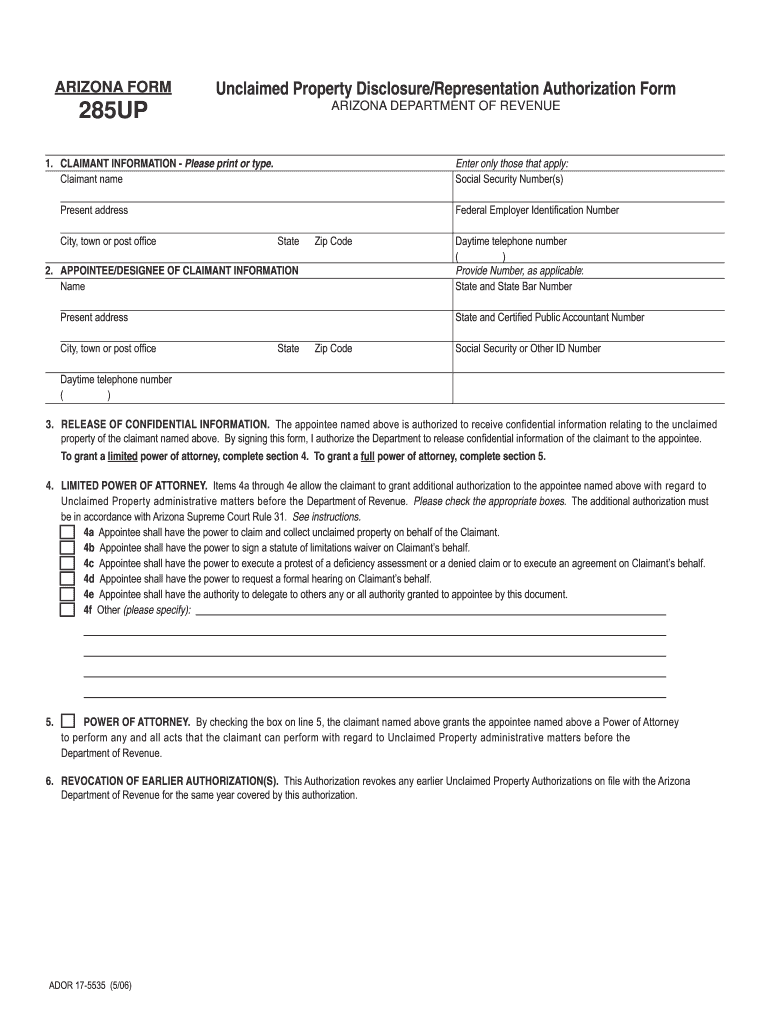

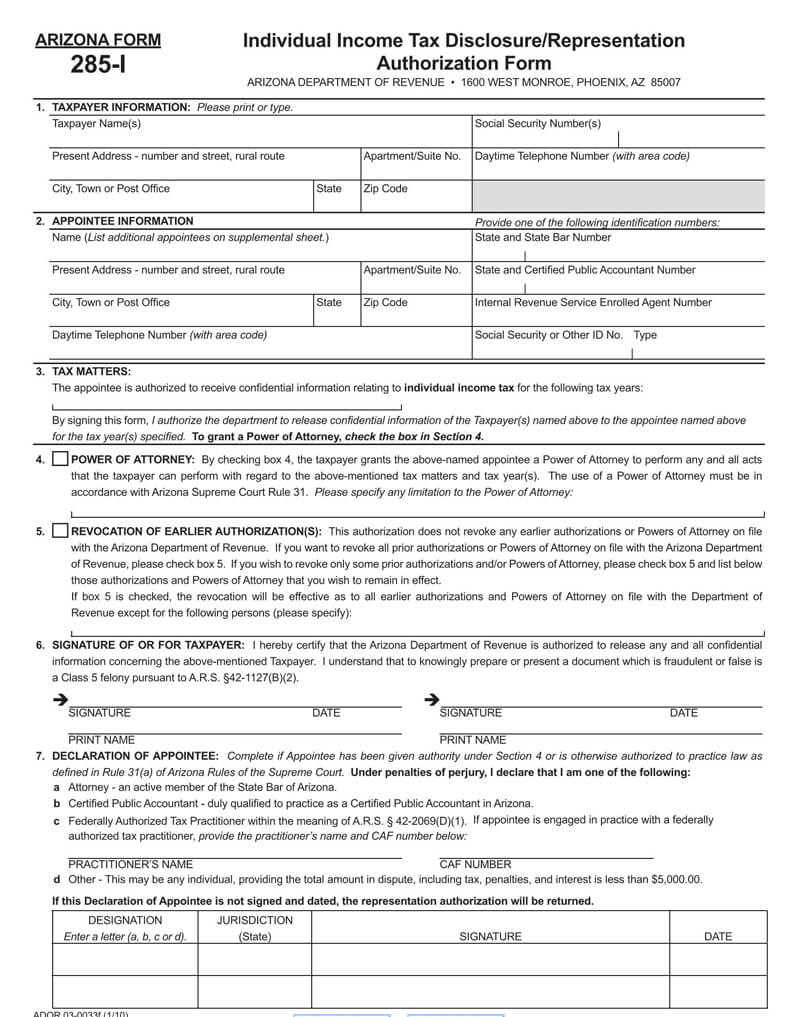

The arizona tax power of attorney form 285 can be used to elect a person usually an accountant to handle another person s tax filing within the state of arizona this document is the only poa form that does not need to have its signatures acknowledged before a notary public or witnessed.

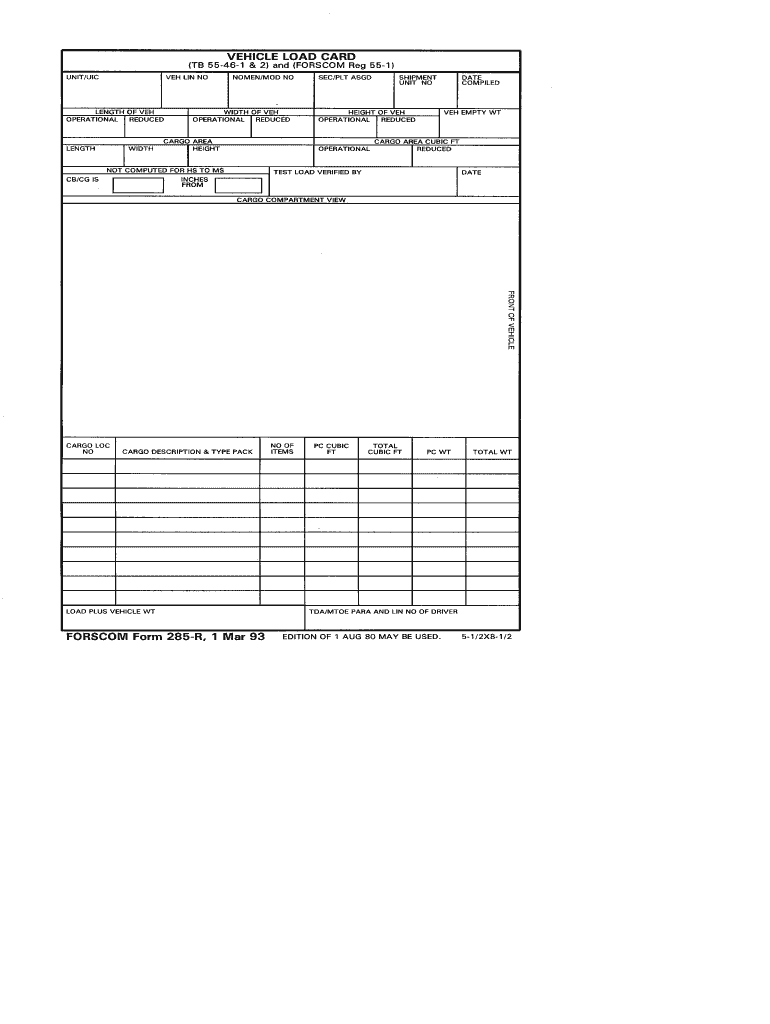

Arizona power of attorney form 285.

Typically this form will be attached to the tax filer s state income tax return sent to the.

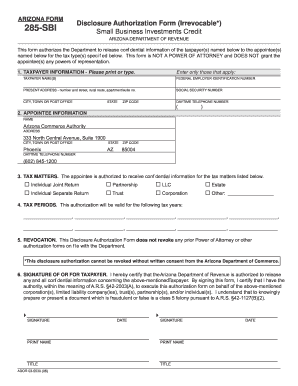

Corporations having controlled subsidiaries.

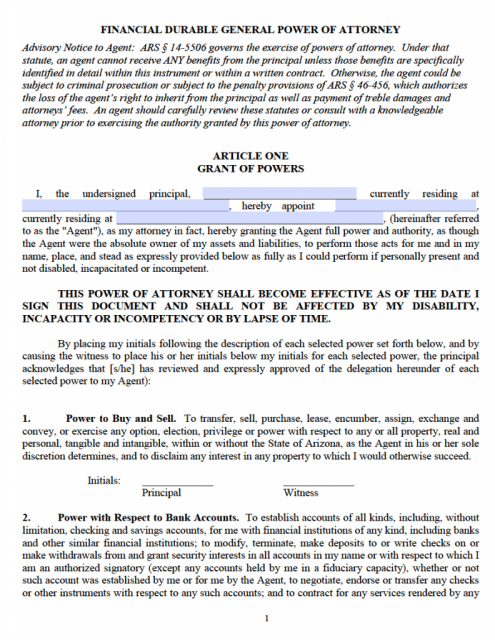

A taxpayer may also use form 285 to grant additional powers to the appointee up to and including a power of attorney.

For example if the principal becomes disabled and cannot file their taxes without assistance the agent is their.

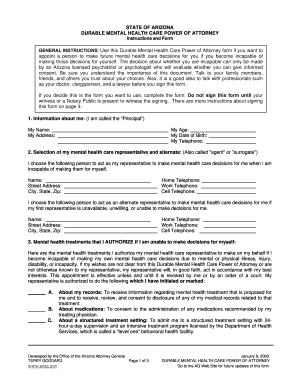

Ador has revised the power of attorney and disclosure process for taxpayers to submit the necessary form.

These forms authorize the department to release confidential information to the taxpayer s appointee.

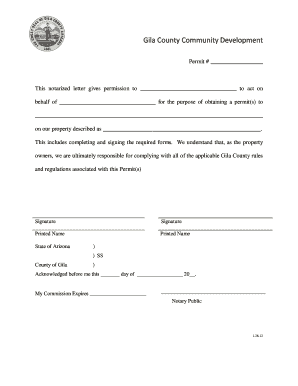

The files included within the law library resource center s website are copyrighted.

Arizona tax power of attorney form 285 i allows a principal to give an agent specific tax related powers of attorney through the tax power of attorney document in the event that the principal finds him or herself unable to work with the state department of finance directly.

A taxpayer may now submit the arizona form 285 and form 285b through email or fax in addition to the mail.

You may use the law library resource center power of attorney forms if.

Power of attorney forms.

The arizona tax power of attorney form 285 can be used to elect a person usually an accountant to handle another person s tax filing within the state of arizona.

Ador 03 0029f 1 10 az form 285 page 2 of 2 7.

Users have permission to use the files forms and information for any lawful purpose.

This document is the only poa form that does not need to have its signatures acknowledged before a notary public or witnessed.

42 2003 a 1 provides that confi dential information relating to a corporate taxpayer may be disclosed to a designee of the taxpayer who is authorized in writing by the taxpayer.

A power of attorney is a legal document which you can use to give another adult the authority to act on your behalf.

This is the only power of attorney document that does not need to be notarized or witnessed by a third 3rd party.

The department may have to disclose confidential information to fully discuss tax issues with or respond to tax questions by the appointee.

You are 18 years of age or older and you live in arizona and you are of sound mind.